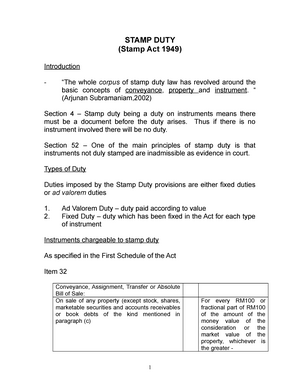

The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949. Property Selling Price Market Value whichever is higher.

C2 Stamp Duty Malaysian Institute Of Accountants

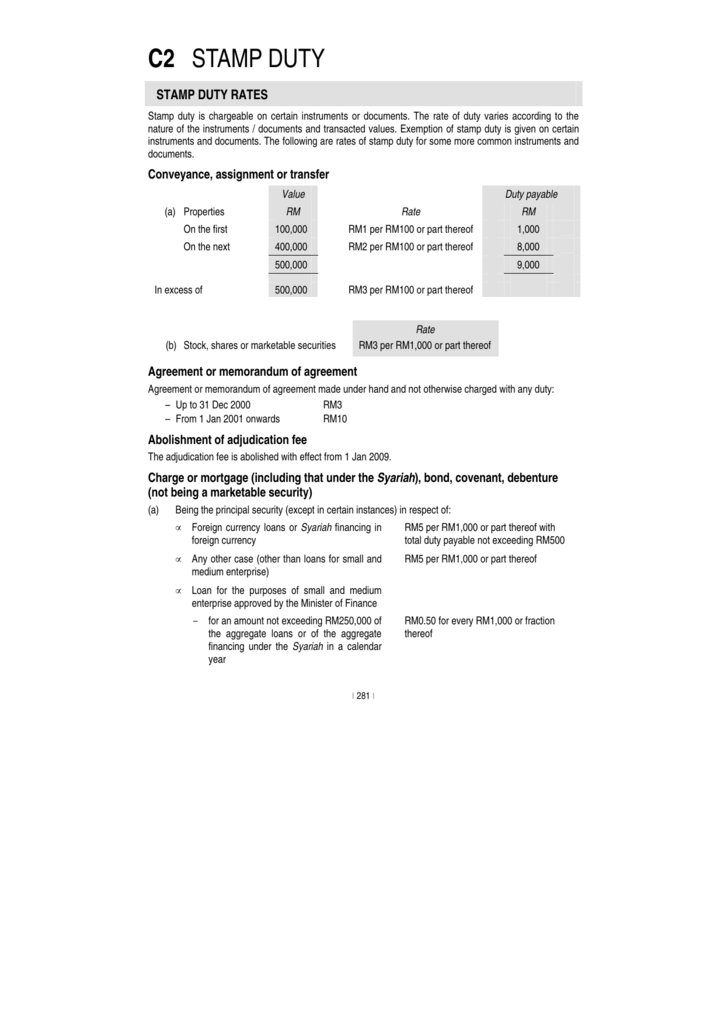

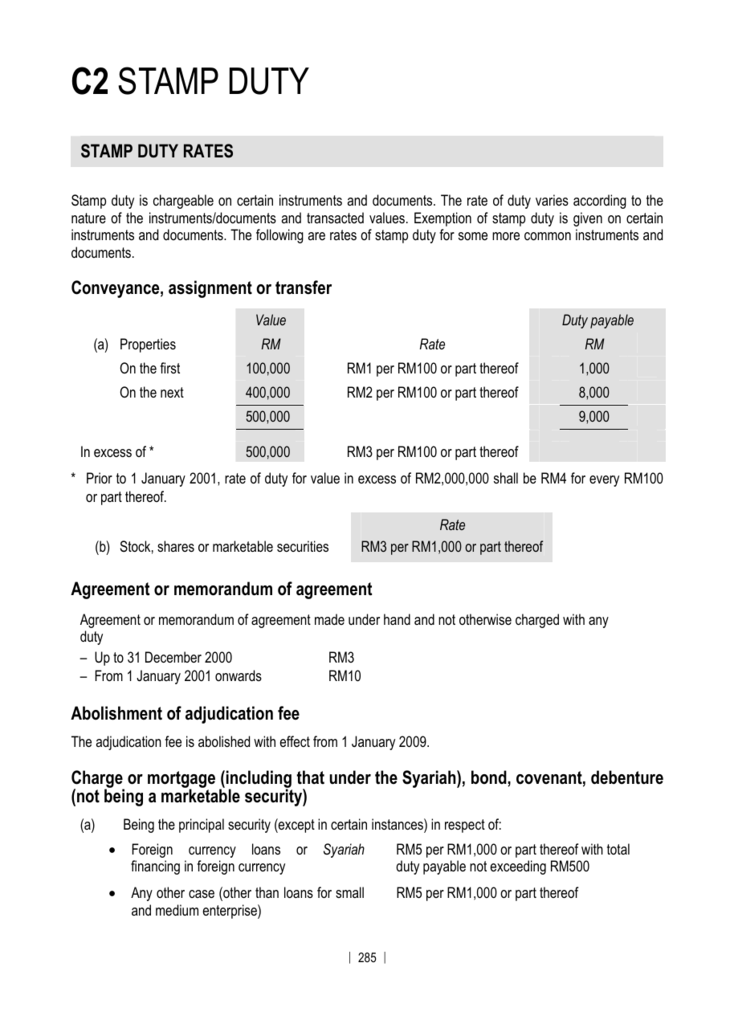

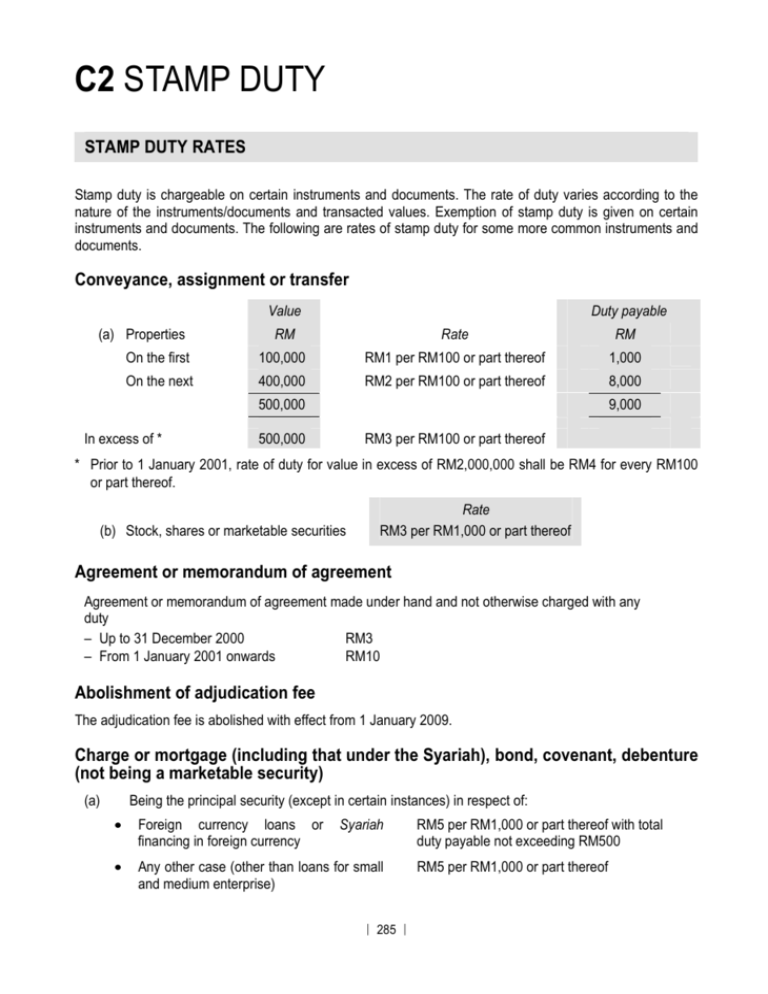

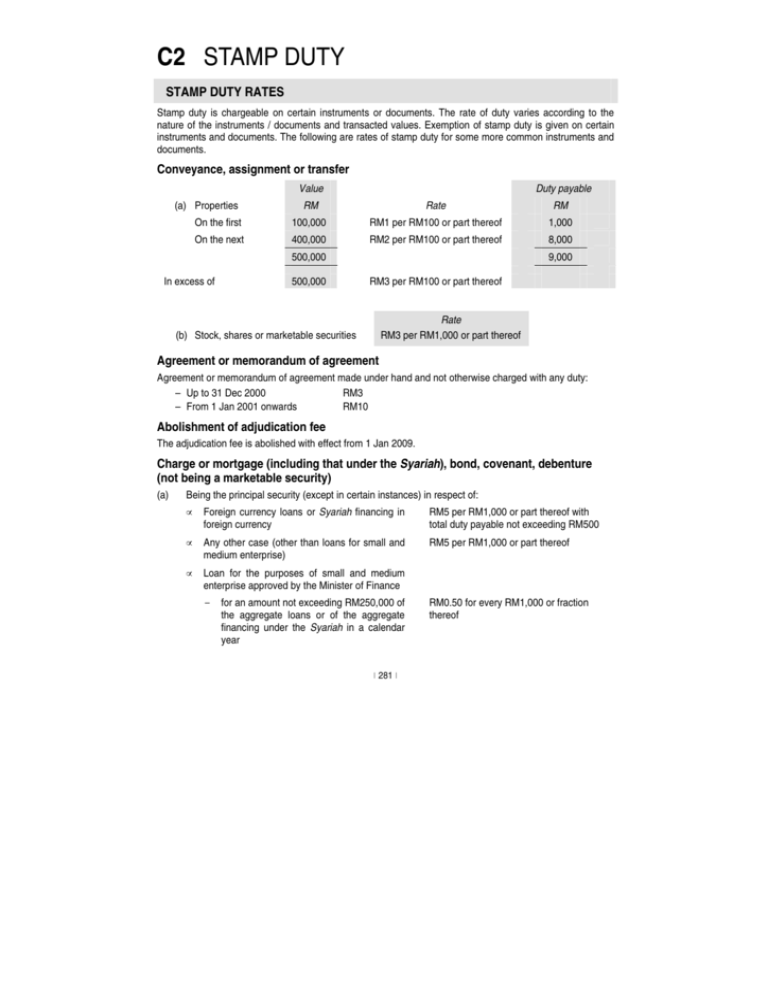

Ad Valorem Duties are variable costs based on the value of a transaction that legal documents represent.

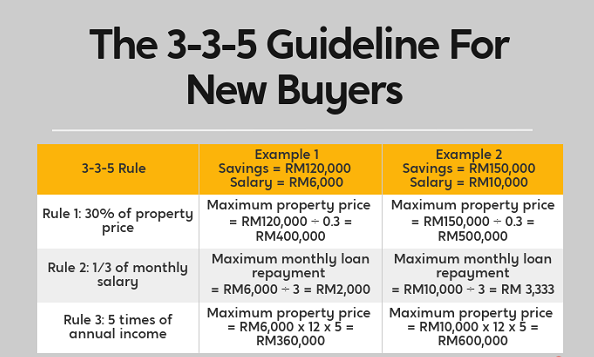

. Ad Valorem Duties The rate of duty varies according to the nature of the instruments and the consideration stipulated in the instruments or the market value of the property. Ad valorem stamp duty malaysia. Stamp duty on a loan agreement is calculated at a fixed rate of 05 percent which is applied to the whole amount of the loan.

The same ad valorem duty as a charge or mortgage for such total amount. B Government contract ie. Following the above the Stamp Duty Remission Order 2021 PU.

So for a property priced at RM500000 you would typically apply for a 90 loan RM450000 - as 10 of the property price will be for the downpayment which you would need to fork out yourself. Stamp Duty When Buying A House 2022 Buying a house has been unequivocally one of the hottest topics that being discussed by Malaysian. For example if the loan is RM400000 the stamp duty payable is calculated as follows RM5 x RM400000 RM1000 RM2000 b When a document is to be stamped.

So for a property priced at RM500000 you would typically apply for a 90 loan RM450000 as 10 of the property price will be for the down payment which you would need to fork out yourself. As an important legal document the loan agreement is also liable for stamp duty. Ad valorem rate of 01.

What this basically means is stamp duty is applicable at a fixed tier for the. Fixed Duties Charged at a set price include stamps for individual policies or copies. Stamp duty on a loan agreement is a flat 05 rate applied to the full value of the loan.

The stamp duty treatment also applies to securities in relation to instruments of service agreements. Between Federal State Government of Malaysia or State local authority and service providers. Stamp duty is the amount of tax levied on your property documents such as the Sales and Purchase Agreements SPA the Memorandum of Transfer MOT and the loan agreement.

It is chargeable on instruments and not on transactions. April 28 2022. The ad valorem duty for the principal instrument of a loan is calculated at RM5 for each RM1000 or part thereof.

Stamp duty rate Saletransfer of properties excluding stock shares or marketable securities Consideration paid or market value whichever is higher. Stamp duty exemption on instrument of agreement for a loan or financing in. Subsequently on March 15 2020 the collector ruled that the consideration paid by the taxpayer to MB Malaysia pursuant to the agreement is the consideration for the purchase of the goodwill of MB Malaysia and raised a stamp duty assessment based on ad valorem rate under item 32 of the First Schedule of the Stamp Act 1949 the Act.

Stamp Duty When Buying A House House Buyer Guide. There are two types of Stamp Duty namely ad valorem duty and fixed duty. Malaysia imposes stamp duty which is payable by the buyertransferee on chargeable instruments.

Pengecualian apa-apa surat cara yang dikenakan duti ad valorem bagi pindah milik hartanah yang digunakan bagi maksud menjalankan suatu projek pelancongan yang layak dikecualikan daripada duti setem. P2P platform registered and recognised by the Securities Commission Malaysia. Total Stamp Duty Payable by Purchaser.

How Much Is The Stamp Duty. If a transaction can be effected without creating an instrument of transfer no duty is payable. Some examples are provided as follows.

In Malaysia Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act 1949. The amount of ad valorem duty that must be paid will vary based on the nature and value of the instruments in question. If an instrument is executed within Malaysia it is.

In general term stamp duty will be imposed to legal commercial and financial instruments. The assessment and collection of stamp duties is governed by the Stamp Act 1949. Ad Valorem Duty is the rate of duty varies according to the nature of the instruments and the consideration stipulated in the instruments or the market value of the property.

Ad Valorem Duty is the rate of duty varies according to the nature of the instruments and consideration stipulated in the instrument or the market value of a property. 100 loan is possible but uncommon for most people. For the ad valorem duty the amount payable will.

Tas surat cara pindah milik harta di bawah Pengecualian di bawah subperenggan 1 hendaklah terpakai bagi surat cara yang disebut dalam. These include taxes such as those based on the value of a property transfer or loan agreement. Stamp duty on a loan agreement is a flat 05 rate applied to the full value of the loan.

Home ad valorem stamp duty malaysia. How can I get stamp duty in Malaysia. Subsequent levels Up to RM50.

Most Malaysian are hopeful to at least own a house. For every RM100 and also for any fractional part of RM100 of the annuity or sum periodically payable. Fixed Duties are charged at a set price and include stamps for individual policies or copies.

Ad Valorem Duties will be imposed on. There are two types of stamp duties which are ad valorem duty and fixed duty. There are two types of duty Ad Valorem Duty and Fixed Duty.

Stamp Duty Valuation And Property Management Department Portal

Chapter 3 Stamp Duty Pdf Chapter 3 Stamp Duty Rem 251 Introduction Stamp Duty Is A Duty Created And Governed By Statute Stamp Act 1949 Act 378 Course Hero

Stamp Duty Notes Statutory Valuation For Auction Rating Wayleave Easement Stamp Duty Stamp Studocu

C2 Stamp Duty The Malaysian Institute Of Certified Public

Revenue Stamps Of New Zealand Wikiwand

Proposed Ad Valorem Stamp Duty To Be Paid When Contract Signed Publication By Hhq Law Firm In Kl Malaysia

Stamp Duty For Transfer Or Assignment Of Intellectual Property Koo Chin Nam Co

Stamp Duty In Malaysia Everything You Need To Know

Ad Valorem Stamp Duty Damian S L Yeo L C Goh

Types Of Stamps And Some Concepts Of Stamp Duty

Stamp Duty In Malaysia Everything You Need To Know

Stamp Duty And Contracts Yee Partners

Stamping A Contract Is An Unstamped Contract Valid

C2 Stamp Duty The Malaysian Institute Of Certified Public

C2 Stamp Duty Malaysian Institute Of Accountants